International cooperation in the exploration of the Arctic

The Rossiya (Russia) nuclear icebreaker navigates

back from the North Pole after providing

support to a mini submarines' mission

to the floor of the Arctic Ocean, Aug. 8, 2007

(no votes) |

(0 votes) |

PhD in Economics, Head of the Production Support Department at Gazpromneft-Sakhalin

Due to enormous hydrocarbon reserves whose commercial extraction may compensate for the oil and gas production drop in its traditional extracting territories, Russia’s continental shelf in the Arctic is currently seen as a key component of economy. World experience in the implementation of hydrocarbon projects indicates that international cooperation in the development of the Arctic fields may generate huge multiplication effect. What kind of strategy should Russia take in its Artic exploits and interaction with foreign partners?

Due to enormous hydrocarbon reserves whose commercial extraction may compensate for the oil and gas production drop in its traditional extracting territories, Russia’s continental shelf in the Arctic is currently seen as a key component of economy. World experience in the implementation of hydrocarbon projects indicates that international cooperation in the development of the Arctic fields may generate huge multiplication effect. What kind of strategy should Russia take in its Artic exploits and interaction with foreign partners?

International Cooperation on the Continental Shelf Development: Global Experience

Today, the growth of the world economy to a great extent hinges on the effective use of oil and gas for energy and chemical industry, with hydrocarbons pervasively consumed in colossal amounts. And the overall trend lies in the increasing share of the offshore deposits that are estimated to cover up to 30% of the global hydrocarbon production.

Efficient and safe exploitation of the Arctic hydrocarbon potential necessitates stronger international cooperation, primarily among the littoral states of the Arctic Ocean.

Russia’s Arctic shelf is regarded as a large region whose commercial development could make up for the oil and gas production decline in Russia's traditional hydrocarbon extraction territories. Its huge hydrocarbon potential may easily fill up a great portion of the country’s energy needs and produce a major economic effect (see Figure 1).

The development of the Arctic shelf is Russia’s key geostrategic objective. However, its accomplishment requires the solution of numerous complicated problems of economic, normative, legal, technical, technological and ecological nature.

Figure 1. Oil and gas potential of the Barents-Kara region (data of the Federal State Unitary Enterprise Arktikmorneftegazrazvedka)

The unique hydrocarbon find in the Arctic shelf (see Tables 1 and 2) [1] has drastically changed the prospects and directions for the development of the fuel and energy complex both in the littoral regions and in Russia as a whole.

Table 1. Characteristics of the Hydrocarbon Resource Base in Russian Arctic Waters

| Parameter | Value |

|---|---|

| Initial recoverable hydrocarbon reserves углеводородов | Approx. 80 billion tons o.e. |

| Additionally in waters disputed by Russia and Norway | 6.5 billion tons o.e. |

| Recoverable oil reserves | Over 400 million tons |

| Gas reserves | Over 8 trillion cu. m |

| Hydrocarbon exploration coverage | 6.3% |

| Hydrocarbon deposits | 25 |

| Local entities (found and prepared) | 524 |

| Deep drilling efficiency | 27,000 tons o.e per meter |

Table 2. Characteristics of Geology Survey in the Arctic Waters

| Sea | Deep Drilling Volume | 2D Seismic Survey | 3D Seismic Survey | ||

|---|---|---|---|---|---|

| Meters | Holes | Thou. km | Density. km per sq. km | Sq. km | |

| Pechora | 70.83 | 21 | 83.7 | 0.8 | 2191.5 |

| Barents | 93.63 | 34 | 275 | 0.27 | 2404 |

| Kara (with gulfs and bays) | 52.29 | 28 | 126.5 | 0.13 | 3159.5 |

| Laptev | - | - | 30.2 | 0.04 | - |

| East Siberian | - | - | 8.8 | 0.01 | - |

| Chukchi | - | - | 13.3 | 0.03 | - |

| Total | 216.75 | 83 | 537.5 | 1.28 | 7755 |

Efficient and safe exploitation of the Arctic hydrocarbon potential necessitates stronger international cooperation, primarily among the littoral states of the Arctic Ocean. To this end, quite important seem to be their coordinated actions and control of strategic national interests.

As seen from global practice, nowadays there are two main approaches to the organization of international partnership in the Arctic.

One is the open door policy pursuing the admission of foreign capital at all stages of the energy potential development.

The other involves restrictive state policy pursuing complete detachment of foreign capital from the geological survey, while conditionally attracting it only at a production stage. At the same time, unprecedented steps are taken through the acquisition of shares in foreign hydrocarbon projects.

Approach number one allows the state to quickly and relatively efficiently launch production with the help of foreign firms that adopt a major role in work financing and risk management. However, the state becomes limited in the advancement of its national market of services, technologies and shelf development know-how, as well as in generation of value-added products.

The advantage of the second approach to international cooperation may be found in the opportunities to form the national market of services and acquire shares in foreign projects. The implementation of the scheme requires substantial state assets needed to take over a portion of the shelf operations, as well as the elaboration of balanced industrial, investment and foreign policies.

Quite attractive and usable for Russia seem to be the practices of Norway.

Approach number one is exemplified by Denmark that sells licenses for geological survey and potential production in its West Greenland waters to the Norwegian Statoil, Canadian Encana Corporation and American Conoco Philips. And it should be noted that of late there have been made no major discoveries offshore Greenland and the Faroe Islands [2].

The second approach is protectionist, which is specific for all other Arctic states. If arranged by the share of foreign capital in the hydrocarbon development, these countries would run as follows: three percent for the USA, about 55 percent for Canada and about 60 percent for Norway [3].

The strictest limitations exist in the USA, whose Arctic fields (in fact, Alaskan) are being developed largely by national capital. At the same time, all-American and Alaskan corporations do spread out to the Russian Arctic, Sakhalin, Norway and Canada.

Norway prefers investments from the US firms that in fact have made possible the production at the Snovit, an important gas field launched in 2007. Also quite active in the development of Norwegian deposits are the French, Italian and German majors.

As far as Canada is concerned, its incontestable key partner is the USA, with many Canadian northern projects based on Norwegian technologies.

The Russian Arctic hydrocarbon sector is the largest among the circumpolar states, which seems to be the reason for Russia to cooperate in the development of the Arctic with a great number of countries.

So far, the predictions boil down to complete dominance of Russian oil and gas condensate reserves in the region. Hence, Russia should consolidate and enhance its supremacy, among other things, through mechanisms of manageable international cooperation.

Quite attractive and usable for Russia seem to be the practices of Norway that may largely attribute its successes in the employment of hydrocarbon resources for the public good to the government policies that encourage partnerships of foreign and national companies. For example, Oslo has obligated foreign firms to launch research programs. As a result, Norway may boast state-of-the-art oil and gas technologies, both developed and put in operation in the country. Back in the 1970s, the state realized the importance of simultaneous stimulation of competition and the development of the national hydrocarbon sector. The share of local goods and services was established by law and in 1972-1974 made up to 90%.

International and foreign companies were given the key role to provide the alliances with technology and to catalyze transformation of their Norwegian partners into full-fledged operators of the offshore deposits.

In the service sector, the JVs were also set up on the principles that have allowed the Norwegian engineering firms to obtain access to the advanced technologies. The experience of Norway indicates that the procedure for foreigners to participate in the hydrocarbon development may serve as an effective tool for dealing with a variety of technological, economic and social problems.

Importantly, a sensible strategy for the management of the oil and gas complex would not cancel out the benefits of international cooperation and integration, as well as possible transfer of the invaluable deposit development technological practices from foreign partners.

The establishment of the Shtokman Development AG in 2008 made a practical example of international cooperation in the Arctic exploration. The joint venture has incorporated Gazprom (51%), Total S.A. (25%) and Statoil ASA (24%), all of them world majors aiming to implement the Shtokman first stage. The powerful consortium should guarantee that the project receives superlative technologies, safety and efficient corporate management.

Interaction of Russian and foreign companies is significantly hampered by the imperfect Russian law on the offshore development.

Apart from the French Total and Norwegian Statoil, among the key Arctic shelf players are American Exxon Mobile and General Electric who in June 2012 signed protocols of intent and agreements on cooperation with Rosneft. The companies' plans concentrate on the accumulation of knowledge and experience, creation of technologies and equipment for the Arctic offshore deposits, as well as the completion of full research and design cycle for the shelf development. Also envisaged are specialist exchanges and cooperation in advanced training and skill conversion for the personnel.

One more important Arctic offshore player is the Italian Eni that signed the Agreement on Complex Cooperation in April 2012. The contract stipulates setting up a JV for the development of Fedynski and Central Barents blocks in the Barents Sea and the Western Black Sea block in the Black Sea, technology and personnel exchanges, and participation of Rosneft in Eni's foreign projects. Technology exchange also makes a major component of the complex cooperation scheme. Highly experienced in operations offshore Norway and other countries, Eni is expected to notably contribute in the JV technological potential.

Currently, the interaction of Russian and foreign companies is significantly hampered by the imperfect Russian law on the offshore development.

Given below are the main elements of the legislative regulation of shelf operations in comparison with foreign practices (see Table 3 [4]).

Table 3. Key Elements of Legislative Regulation of Shelf Operations (Foreign and Russian Practices)

| Element | USA | Canada | Great Britain | Norway | Russia |

|---|---|---|---|---|---|

| Legislation | + | + | + | + | Available although poorly adapted to offshore specifics |

| Government control of the works | + | + | + | + | Available although poorly adapted to offshore specifics |

| Procedure for the extension of the right of the offshore subsoil use, requirements to participation in subsoil use | + | + | + | + | Available although poorly adapted to offshore specifics |

| Specific ecological and nature protection norms in extension of offshore blocks | + | + | + | + | + |

| Procedure for financing of works related to offshore subsoil development | + | + | + | + | - |

The current Russian law contains major gaps and controversies, which points to the need of its amendment along the following key lines (see Table 4 [4]).

Table 4. Guidelines for the Amendment of the Russian Law on Continental Shelf

| Proposal | Substantiation | Proposal Realization Mechanism |

|---|---|---|

| Legislative consolidation of principles to stimulate private investment in geological survey of Russia’s continental shelf | High capital intensity of offshore projects and shortage of public assets to ensure overall financing of geological works | Legislative consolidation of rights for subsoil user who has performed geological survey on risk basis to enable him to explore and exploit the discovered deposit. Legislative consolidation of subsoil user right to sell geological information obtained within the survey at his expense (including attracted finances) |

| Development, substantiation and normative consolidation of unified principles for activities related to subsoil use within all waters under Russian jurisdiction | Unified principles for legal regulation are needed since the effective law contains varied requirements to the work procedure, for example for continental shelf and territorial waters, which complicates obtaining appropriate permissions, as well as execution of works | Legislative consolidation of a single procedure for economic activities related with subsoil use in Russia’s continental shelf and territorial waters, as well as other waters under Russian jurisdiction |

| Improvement of tax laws to encourage investment in survey and development of offshore hydrocarbons | The existing taxation procedure would not account for operation depth and deposit conditions, which prevents optimization of taxes for individual fields. The law lacks norms to lower the financial burden at the basic investment stage (tax holiday) | Provision of the Russian Tax Code with norms to differentiate mineral extraction taxes, as well as with principles for extension of tax holidays at the field preparation stage. Tax exemption of the investment portion meant for creation and manufacturing of advanced technologies and gadgets for exploration and development of offshore hydrocarbons |

The improvement of the Russian law should step up international cooperation in the development of offshore resources and contribute to the positioning of Russia as a key player in the Arctic shelf.

Instruments of International Cooperation and Technology Transfer

Extremely important for Russia is to use international cooperation for the transfer of foreign technological, organizational and economic practices, as well as knowledge for the efficient development of the Arctic offshore fields for the public good.

The development of hydrocarbon deposits in Russia's Arctic shelf is hampered by harsh climate. Production is planned in the regions with low temperatures, hurricane-force winds and speedy icing. Certain future gas-producing offshore areas feature 1.5-meters-thick drifting ice that significantly raises the operation costs.

Notably, some experts compare continental shelf development to space exploration, or the development of nanotechnologies and electronics. Future offshore projects will require a lot of scientific and industrial breakthroughs – from vessels and drilling platforms to hardware and instruments for geophysical, navigation and other purposes. Offshore hydrocarbon development means capital intensity, advanced marine technologies and high-risk investment.

At this time, extremely important for Russia is to use international cooperation for the transfer of foreign technological, organizational and economic practices, as well as knowledge for the efficient development of the Arctic offshore fields for the public good.

As is known, the oil-and-gas sector suppliers fill up to 80% of works within major hydrocarbon projects. Among them are service companies, large metalworking, construction and transportation firms, vendors of other equipment and materials, as well as research and educational institutions representing various industrial sectors.

In most cases, Russian enterprises may expect winning contests related to general construction, electric installation and other works beyond high-tech value-added production.

Hydrocarbon projects may engage key industrial sectors in partnerships within intersectoral technological chains. Fast progress of these sectors will set in motion other adjacent industries resulting in multiplication effects and self-ignition of economic growth. In fact, it is all about unwinding the upward spiral of the industrial demand to be followed by the investment and consumer boom. According to numerous researches, domestic demand is the main reliable driver of economic and social progress.

As a matter of fact, it is the industry that generates the bulk of the GNP and defines the technical level of other economic sectors and social area. Hence, positive industrial dynamics is to determine the entire vector of societal growth.

Obvious future benefits notwithstanding, hydrocarbon operations are quite new for Russian enterprises. Despite the high-level of intellectual and industrial potential, Russian companies often fail to compete with foreign firms in tenders. They badly need more competence related to international requirements to the quality of products, services, and systems for labor safety, environmental protection and other adjacent activities.

In most cases, Russian enterprises may expect winning contests related to general construction, electric installation and other works beyond high-tech value-added production.

Russia possesses a lot of industrial assets within its military-industrial complex. Due to objective reasons that surfaced in the reformation period, many defense enterprises are either unprofitable or on the brink of bankruptcy.

To this end, there are many Soviet-period enterprises intended for repair and upgrading of the Northern Fleet battleships and submarines in the Kola Peninsula, which is regarded by experts as a promising base for the development of the entire Arctic shelf. They own unique assets and are currently idle in absence of government contracts. A lot of their production facilities could be retargeted to manufacturing the equipment for the oil-and-gas complex. The engagement of defense enterprises seems especially promising in such areas as quality welding, metal structure working and employment of experienced and knowledgeable personnel.

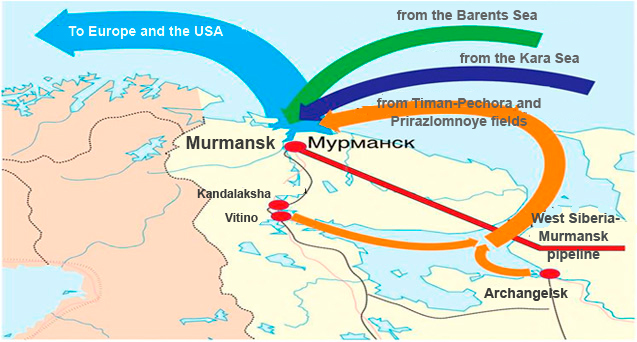

The development of the Arctic shelf and growing oil transportation volumes will inevitably turn Murmansk into industrial base for future offshore projects (see Figure 2), giving an impetus to industry development all over North-Western Russia. Due to its geography and vibrant infrastructure, the Kola Peninsula seems attractive as the place for factories specializing in drilling logistics, field operation, as well as oil, gas and gas condensate transportation, assembly and repairs of platforms and equipment, fleet servicing and social welfare with the help of available industrial facilities and labor.

Fig. 2. Murmansk port as a hub for hydrocarbons delivery to markets

Today, Murmansk seems to be as strategically important for Russian economy in view of the Arctic hydrocarbon development as was the Norwegian Stavanger and Scottish Aberdeen when oil production in the North Sea was commenced more than 30 years ago.

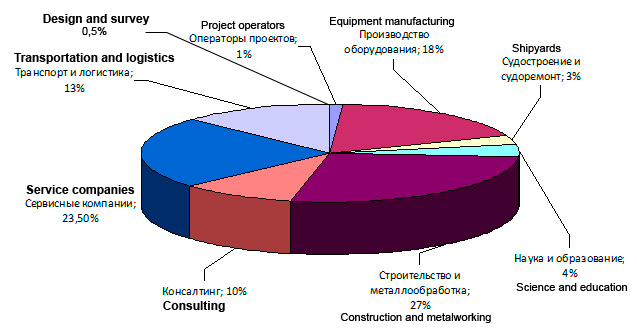

An early example of an effective international cooperation in the transfer of global experience, know-how and technologies is the Association of Suppliers for Oil and Gas Industry Murmanshelf. Set up in 2006, it unites over 230 enterprises and organizations willing to take part in the implementation of the Arctic hydrocarbon projects. Among them are Russian and foreign operators, general contractors, shipyards, oil servicing, construction, transportation logistical and machine building enterprises, as well as educational and research institutions from Russia and other countries (see Figure 3).

Notably, the Association is a practical outcome of collaboration provisions within the Memorandum of Understanding on Technical and Economic Cooperation signed by the Murmansk Region Government and Statoil ASA. The Norwegian oil and gas corporation has rendered hefty financial, intellectual and organizational assistance in preparation of regional industry to the realization of the Arctic projects.

Fig. 3. Structure of Murmanshelf Association by activities

The Association is aimed to prepare the local industry to projects, organize the transfer of international practices and technologies, and unite enterprises willing to participate in the joint development of the Shtokman gas condensate field and other deposits on the Arctic shelf.

International cooperation orientated to the transfer of unique technologies, know-how and knowledge may build a drastically new national oil servicing sector to ensure safe and efficient development of the Arctic fields.

Since its foundation, the Association has held over 30 international seminars to raise competence of the member-companies that are going to pose as hydrocarbon sector suppliers. During the training seminars the Norwegian specialists use practical examples to demonstrate the specifics of bidding procedures and proper positioning of industrial enterprises to serve as suppliers for the oil-and gas sector. The Association renders consulting services to its members, provides them with appropriate scientific, technical, economic and legal information, as well as arranges experience exchanges.

As a result, many regional enterprises, primarily small and medium-sized businesses, have changed their development strategies to concentrate on technical upgrading and skilled personnel training.

Murmanshelf is a growing transnational offshore hydrocarbon cluster intended to promote international cooperation of the authorities, science and business. As far as the Russian economy is concerned, the Association presents a new form of international integration of resources for reaching common strategic goals, strengthening and expansion of markets, as well as sharing risks and profits.

Hence, Russia both can and should earn not only and not just from hydrocarbons production but also from competitive technologies and equipment. International cooperation orientated to the transfer of unique technologies, know-how and knowledge may build a drastically new national oil servicing sector to ensure safe and efficient development of the Arctic fields. If implemented, the program would significantly improve the nation’s competitiveness. And every tool should be employed not to miss the emerging chance.

1. V.Ananyev, Russia Has no Time for the Arctic Shelf // Oil & Gas Journal. May 2010. Page 38

2. D.S.Chumakov, Key Vectors of International Cooperation in the Arctic // Series 25. International Relations and World Politics. 2011. № 2. Pages 41–61

3. S.M.Bogdanchikov. Key Factors of Russia’s Hydrocarbon Sector Development and Rosneft // Oil, Gas, Business. 2003. № 4. Pages 16–17

4. A.M.Fadeyev. Improvement of Economic Approaches to Management of Hydrocarbon Deposit Development in the Arctic. Apatyty: Publication of the Kola Science Center, Russian Academy of Sciences, 2012

(no votes) |

(0 votes) |