«Oil & Gas Dialogue» IMEMO RAN

In

Log in if you are already registered

As the world continues to scuffle against the most severe economic crisis, optimism remains thin in the air, conceivably as uncertainty is easier to sell. The IMEMO RAN forum was no different, as industry specialists pleaded for more assistance whilst the government officials naturally attempted to ignite market confidence. At the end, one could not ignore the sense that the both sides were exaggerating for their own vested interests. There will be no immediate Mayan apocalypse as some may have felt, but in today’s world things change quickly making one ponder – what must be done to stop any changes, how to adapt to them if they occur and what if sceptics are right?

«Oil and Gas Dialogue: Russian Gas in the European Market» Joint International Forum held at IMEMO RAN conference hall on 7th December 2012; moderated by Ivanova N. I., RAN Academic and Associate Director of IMEMO RAN, and Eric Dam, General Director of Energy Delta Institute.

Optimism Remains Thin in the Air:

As the world continues to scuffle against the most severe economic crisis, optimism remains thin in the air, conceivably as uncertainty is easier to sell. The IMEMO RAN forum was no different, as industry specialists pleaded for more assistance whilst the government officials naturally attempted to ignite market confidence. At the end, one could not ignore the sense that the both sides were exaggerating for their own vested interests. There will be no immediate Mayan apocalypse as some may have felt, but in today’s world things change quickly making one ponder – what must be done to stop any changes, how to adapt to them if they occur and what if sceptics are right?

Real vs. Unreal Uncertainty:

A problem distinguishing between real and superficial uncertainty is that any expert is naturally biased and many simply do not know what to expect from the volatility of today’s market. In regards to the industry’s statistical toolkit, it is at best questionable as for years oil and gas supply and demand projections have been too optimistic and inconsistent; statistically altering to such an extent that the last edition never resemble anything of the new. The general consensus at IMEMO RAN was that 2015 figures are flawed and need urgent re-evaluation as European demand is unlikely to grow and could drop. Further, not only figures exacerbate the issue of uncertainty, as a lack of any European energy policy makes projections exceptionally difficult. In all, a tricky analytical concoction is present as examination of current developments is limited by quantitative and qualitative issues.

On the one side, Europe argues for green policy, on the other, it upturns this view by importing highly polluting, albeit relatively cheap, US coal. Aside from sending a bad message to developing nations in regards to reducing CO2 emissions, which partially due to this move are now increasing in the E.U., it also breeds uncertainty as this flip-flopping makes the European continent less predictable for Russia. A clear distinction is apparent as Europe has previously acted shrewdly when conducting business with a well packed bargaining arsenal which had an array of tools, be it: alternative energy or environmental projects, an alternative supplier (e.g. US coal) or an event (Russo-Ukrainian Gas Price Dispute); all aimed at lowering prices for European consumers. But, recently Europe has shifted from shrewd trade to the reengineering of the energy sector, which does not account for industry realities or Russian and peculiarly even its own interests as it is undermining its own energy security.

Long-Term Contracts a No-No:

An area of contention stimulating uncertainty is the debate amid long-term contracts and hub trading which is set to be introduced across Europe. An official justification is that Europe feels that gas is overpriced and super-natural profits are recorded by the Russian gas monopoly. At IMEMO RAN Sergei Komlev, Gazprom Export Head of Department for gas Contracts and Pricing, “rebuffs the overpricing myth” by arguing that raw materials increased on average 3-4 times resulting in a natural price increase as pipeline construction or alike now costs more. Also, the European centre-periphery model has altered with population becoming less concentrated requiring an additional infrastructure, thus expenditure. In fact, Gazprom has reduced prices by pursuing its own strategy of spreading costs by building more pipelines and supplying more gas; South Stream pipeline introduction resulted in lower prices for European consumers.

That said, Europe still does not agree, wishing to fit a North American Model where long-term contracts are near absent as purely basic economic principles of supply and demand determine price. This is not yet possible due to a lack of infrastructure across Europe, especially costly storage, as gas is seasonal requiring storage during summer as circuits must be loaded and cannot be just shutdown. So, currently a hybrid system exists with spot pricing, fixed gas to oil pricing and with hubs which only work after 70-80% of the market is satisfied by the normal pipeline network. On the positive side hub prices tend to be cheaper, but the difference is not huge in contrast to the feasible risks. During 2011-2012 hub prices in Europe had shown that the blend of speculation and erratic weather could create a dangerous cocktail with severe gas shortages. In the established US market similar scenario occurred in 2001 as prices determined by the demand and supply spiralled due to shortages resulting in extortionate consumer rates. With long-term contracts such seasonal, speculative and erratic events are less likely.

Mutual Interests are Vital, But are They?

Albeit, the customer is always right is a business cliché. It still underlines that Russia needs to appreciate European interests as it is its biggest market and will be at least in the foreseeable future. A recent contract among Russia and Germany which will bear 6% of the latter’s energy needs, shows evolution of the former’s business approach and the fact that both sides can mutually benefit; the contract is a hybrid, as it is both long-term and incorporates hubs to determine pricing. But equally, the rest of Europe must value Russia’s interests in this interdependent bond as no one else can offer as much gas. E.U. must aid predictability by outlining an energy policy and do so on mutual terms, especially with what pace 70-80% ratio mentioned earlier will fall. Also the legal action against Russia’s gas giant is unproductive as unlike North America – Soviet, Russian and European infrastructure cannot sustain small independent firms trading freely as the pipe-network is not as connected. Further, geographical distances are too vast for small firms due to high barriers to entry, while the immature business and legal climate on all sides involved does not allow for logistics yet to be breached.

Tatyana Mitrova - Vital Challenges for Russia:

As Tatyana Mitrova, Head of World Energy Markets Centre of the Russian Academy of Sciences and Head of Global Energy at Skolkovo, sees, there are three interlinked challenges for Russia. As mentioned, Russia must tackle its investment climate from its own side to allow for dynamic logistics, with transparency being vital. For instance Gazprom says it exported 150 billion cubic meters of gas, but only 107 billion was in fact pumped. Further, price disparity must be addressed with an informative business model. Sochi pipelines are 10 times smaller in diameter than Nord Stream’s, but cost more. Such lack of economies of scale is common as well as the price disparity due to Gazprom buying gas at almost any price. So it will be vital to reach equilibrium as for instance Europe has hit the other polarity by having too much legislation, as populated areas need around 700 local, regional and central government patents to erect 500km of pipes (Nord Stream). With transparency, NIMBY (not in my back yard) challenge can be also addressed, as stakeholders will be less likely to oppose the presence of the energy industry and fragmentation challenge could be avoided or renegotiated.

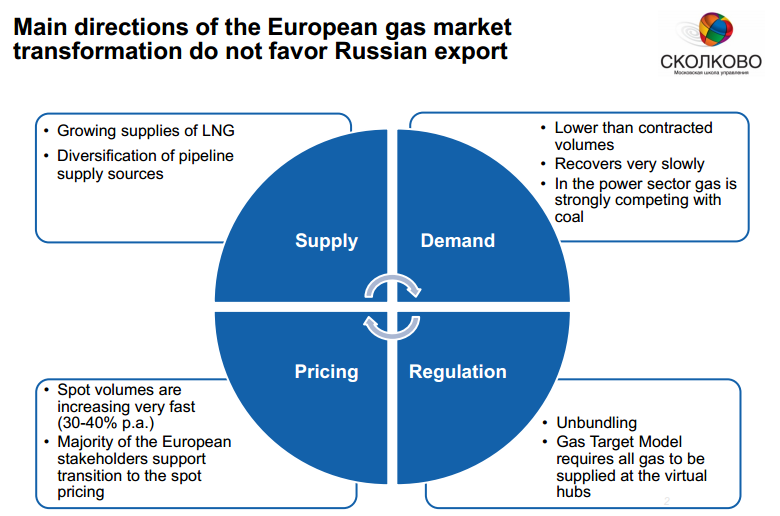

Tatyana Mitrova provides a great summary, in her Skolkovo presentation, outlining the overall mood of the event - as the slide below illustrates:

Don't Despare - an Oasis can be found in this Desert:

In all, a lot of changes are needed, being desired and enforced upon Russia with quite a pessimistic mood. But this should not be the case as Russia does not need to lose income by lowering prices, as more efficiency can offset lower prices especially if the European partners can be integrated into the mix. Gas cannot be sold forever at $400 per 1000 cubic meters, as alternatives exist, and if prices are not lowered they will be considered by the consumers. So, rather than seeing the recent events as a threat, they should be viewed as a chance to diversify, become more efficient or even transparent.

Igor Ossipov

Oil & Gas Eurasia Correspondent, Oil/Diesel Broker and RIAC Blogger.