Ukraine In Between the Unions: the Customs Union and the EU

Independence Square Kiev December 4, 2013

In

Login if you are already registered

(no votes) |

(0 votes) |

PhD in Law, MGIMO University

The Ukrainian leadership’s decision to suspend the country’s accession to an association agreement with the EU has caused a wave of mass protests by both opponents and supporters of EU integration. The development has served as a graphic demonstration of the differences within Ukrainian society and the political divide that marks the schism.

The Ukrainian leadership’s decision to suspend the country’s accession to an association agreement with the EU has caused a wave of mass protests by both opponents and supporters of EU integration. The development has served as a graphic demonstration of the differences within Ukrainian society and the political divide that marks the schism.

It is the people of Ukraine who should decide whether the country is to join the Customs Union or opt for European integration and the signing of an association agreement with the EU. Kiev should proceed from an understanding of the implications this step will have for the Ukrainian economy, industry, agriculture, and society.

Ukraine and the EU Association Agreement

Ukrainian companies will not survive tough competition with EU goods. To be able to compete with European producers, Ukraine needs to make massive investments to upgrade its industrial potential and make it compatible with European technical regulations and standards. However, the Ukrainian economy does not appear capable of making this happen.

On the one hand, Europe is a large market, with advanced technology and important economic potential, let alone a wealth of cultural and historical heritage. Therefore, EU integration appears quite attractive.

But on the other hand, Europe’s powerful industrial sectors would leave Ukrainian manufacturers with no chances. Ukrainian companies will not survive tough competition with EU goods. To be able to compete with European producers, Ukraine needs to make massive investments to upgrade its industrial potential and make it compatible with European technical regulations and standards. However, the Ukrainian economy does not appear capable of making this happen. President Yanukovich believes his country’s economy would require 160 billion Euro to adapt to European standards.

Moreover, a lengthy transition period would be needed to harmonise phytosanitary rules, licensing issues, antidumping procedures, and technical regulations and standards according to EU requirements. Until this process is over, Ukrainian goods will not be able to enter the European market. Another country knocking at the doors of the EU, Turkey, signed its association agreement in 1963, and has so far taken 50 years to harmonize its rules.

Андрей Кортунов:

Европейский Союз потерпел неожиданное,

обидное и сокрушительное поражение

In addition, by signing an association agreement, Ukraine would have to agree to a number of rather dubious requirements. Appendix XXXI of the agreement commits Ukraine to implement the EU Directive on interoperability of railways in the union. Under this commitment, Ukraine would have to change its railways from 1520 mm gauge to 1435 mm in accordance with the European gauge standard, which clearly is totally unrealistic.

It is unlikely that the European partners will pay for the modernization of the Ukrainian economy, but they may strip relatively profitable assets and leave Ukraine without a national production base. Of relevance here is the story of Krivorozhstal, Ukraine’s steel producing giant, acquired in 2005 by the world’s largest metal group, Mittal Steel, which paid USD 4.8 bln under the deal. The group failed to invest in modernising operations, but instead used the facilities to the utmost potential. Today, the factory is in serious trouble and has had to lay off its employees under a “voluntary retirement” programme, while decreasing output is causing yet another spiral of conflict between owners and the trade union.

The Baltic countries’ experience also offers an important lesson: European bureaucrats demanded that all former Soviet enterprises be shut down. As a result, RAF automakers, the VEF electronics plant and other large businesses had to stop production. Another painful outcome was shutting off the reactors at the Ignalina Nuclear Power Plant, with resulting electricity shortages undermining business expansion plans and driving up utility tariffs. Accession to the EU led to an increase in the informal economy across the Baltic countries. According to a study by the Johannes Kepler University in Austria, 29 per cent of economy in Lithuania, 28.6 per cent of that of Estonia and 26.5 percent of Latvia’s economy belong to the “grey” sector. The same is likely to happen to Ukraine’s high-tech production, threatening its aviation and aerospace industry, machine-tool industry and shipbuilding.

It is unlikely that the European partners will pay for the modernization of the Ukrainian economy, but they may strip relatively profitable assets and leave Ukraine without a national production base.

What can Ukraine offer to European consumers? The country has agricultural products, mineral resources and metals. But, at the same time, Ukrainian agricultural producers do not have much by way of a future. A free trade zone with the EU does not mean that their products will “flood” Europe, since appendices to the association agreement impose certain constraints. Ukraine would have to cut its wheat exports to Europe from the current 3 million tons a year to 950,000 tons. It would be allowed to supply only 10 per cent of current corn exports. In addition, Ukrainian agribusinesses cannot avail themselves of the same level of government support as their European competition: in 2011, agricultural subsidies in EU totaled almost Euro 86 bln.

Quite obviously, the worsening of exports would only undermine the negative balance of trade in Ukraine even further. According to Russian Presidential adviser Sergei Glaziev, should the association agreement be signed, Ukraine’s negative balance of trade would grow by USD 2-5 bln, making it imperative to raise more debt. However, because of the steady worsening of the country’s sovereign credit rating, Western financial institutions are not rushing into lending to the Ukrainian economy, making the risk of default even stronger. Only Russia helped Ukraine ‘step away from the precipice’, with its loan of USD 750 mln made on preferential terms. Support from Russia has demonstrated its interest in seeing the Ukrainian economy become strong and stable.

Ukrainian agricultural producers do not have much by way of a future. A free trade zone with the EU does not mean that their products will “flood” Europe, since appendices to the association agreement impose certain constraints.

Apparently, Ukraine must look for new sources of long-term growth, the association agreement being hardly an effective solution. Even under the most favorable scenario of a free-trade zone, Ukraine’s GDP could shrink by almost USD 1 bln by 2020.

An association agreement would not only reflect negatively on the country’s economic well-being, but would also affect its population. It is very likely that migration from Ukraine would increase, with the majority of the flow comprising highly skilled labor and young people. According to V. Muntiyan, a distinguished Ukrainian economist and full member of the Ukrainian Academy of Sciences, Ukraine may lose over 7 million young and active people. The East European and Baltic countries serve as a good example: Romania lost 12 per cent of its population over the past decade, and Latvia and Lithuania 13 per cent each.

Joining the free-trade zone, Ukraine would have to integrate into the EU’s Common Defence and Security Policy and converge with NATO. The joint Russian-Ukrainian defence programmes would, quite naturally, have to be curtailed.

Joining the free-trade zone, Ukraine would cease to be a partner with whom Russia could negotiate productively. Ukraine would have to delegate its foreign trade regulation to the EU and have to comply with EU directives on trade policies, technical standards and sanitary controls. At the same time, Ukraine would not be able to influence these directives in any way, since it is too early to expect full membership in the European Union. The terms and conditions of its trade and economic cooperation with Russia would have to be negotiated with Brussels as an intermediary. Ironically, Ukraine, which has always insisted on its independence in all integration processes across post-Soviet countries, appears to be so easily and voluntarily giving up its sovereignty to the EU.

The benefits of joining the European free trade zone are largely declarative in nature, and their effects should only be expected in the very distant future. And any speculations about doors being thrown open to Ukrainian business, Ukraine acquiring the best, democratic practices and implementing better trade and completion rules, and the country becoming better protected in trade disputes, are largely academic.

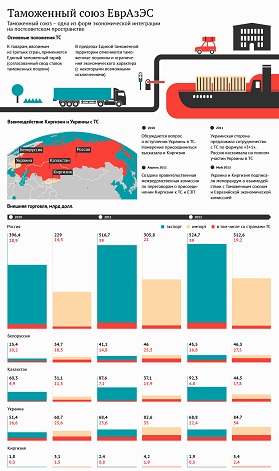

Ukraine’s Prospects in the Customs Union

If the choice is made soberly, the advantages of integrating with the Customs Union become apparent. The geographic pattern of Ukraine’s foreign trade is serious reason enough for such a choice. According to the Ukrainian State Statistical Service, in 2012 Ukraine’s balance of trade with the countries of the Customs Union amounted to USD 56 bln, compared to a total with Europe (beyond the EU) of approximately USD 45 bln. Russia is the largest investor in the Ukrainian economy, accounting for almost half of its accrued foreign investments. Overall, Ukraine exports over 42 per cent of its technological products and 60 per cent of its finished goods to Russia.

It is very likely that migration from Ukraine would increase, with the majority of the flow comprising highly skilled labor and young people.

In contrast to the EU, the Customs Union offers real, tangible benefits right away. According to Sergei Glaziev, Ukraine would gain an additional almost ten billion dollars annually, resulting from lower prices for Russian energy (down, almost by two thirds third, to USD 160 per thousand cubic metres); the opening up of a huge food market of 160 million people, with no quotas for Ukrainian producers; the elimination of export duties; and broader cooperation in the machine-tool industry. The total effect from joining the Customs Unions, according to various estimates, would result in 7 per cent incremental growth of GDP by 2030, or USD 220 bln added to national welfare.

Opponents of Ukraine’s integration with the Customs Union allege that Ukraine would have to accept bondage to Moscow, which is akin to yet another myth of Russia’s attempts to restore the ‘Soviet empire’. The governance mechanism within the Customs Union calls for equitable participation of all its members, irrespective of the size of their economy. If Ukraine does not like this or any other decision, it may veto it, and there are no ways to obviate such veto. Ukraine would never have such a ‘loud voice’ talking to its EU partners.

Russian President Vladimir Putin at a meeting

with Ukrainian President Viktor Yanukovych

Opting for the Customs Union, Ukraine would also strengthen its bargaining positions on the international stage and within the European Union. The Customs Unions has always stood guard on the interests of its producers and protected them from unfair competition. Becoming part of the Customs Union, Ukraine would enjoy more trade preferences, among others, with Europe, than under the association agreement.

In addition, Russia has never contrasted the European and Eurasian directions in cooperation. Integration in the west and in the east should complement each other, ultimately leading to a drastically different architecture of economic cooperation across the breadth of space from Lisbon to Vladivostok.

One is reminded of the negative reactions made by states of the Customs Union to Ukraine’s plans to accede to the free trade zone. It is only to be expected that Customs Union members would have to apply restrictive duties to European goods coming to the Union’s market via Ukraine. Addressing the Supreme Eurasian Economic Council on 24 October 2013, Russian President Vladimir Putin announced that Ukraine would not be able to join the Customs Union if it signed the accession agreement with the EU. Russia “reserves the right to resort to Protocol 6 of the CIS free trade agreement to protect its market.” Ukrainian goods “will not be subject to preferences under the free trade zone, but will be treated under the so-called most favoured nation rule”. Since Russia accounts for about a quarter of Ukraine’s exports, its economy is bound to suffer.

Integration in the west and in the east should complement each other, ultimately leading to a drastically different architecture of economic cooperation across the breadth of space from Lisbon to Vladivostok.

After the collapse of the USSR, CIS countries continued to share its economic operations. Currently, many businesses in Russia and Ukraine belong to the same production chains; we have a shared infrastructure and electricity system. High-tech businesses enjoy special terms and privileges. In the event of a free trade agreement with the EU, all these preferences will have to go. This is particularly dangerous for innovative areas of Ukrainian economy that will come under strong pressure from their European competition, while at the same time be deprived of any support from their eastern neighbours.

One example is the nuclear power industry. By early 2013, Russia’s state corporation Rosatom had a portfolio of foreign trade contracts worth USD 69 bln, not counting nuclear power plants to be built in Russia. Ukrainian nuclear engineers were supposed to contribute to these plans. The free trade agreement with the EU requires that Ukraine accept the rulings of the European Atomic Energy Council that would dictate to Ukraine its terms and conditions. Ukrainian manufacturers risk forfeiting beneficial joint projects as well as guaranteed supplies of cheaper nuclear fuel from Russia for their nuclear power plants.

Russia and Ukraine: what’s next?

Although Ukraine has not joined the free trade zone, this does not mean that it has decided to accede to the Customs Union. It will continue to balance between two centres of power. Going forward, such wobbling is bound to repeat itself, and because of its geographic location, economic structure, and public opinion, Ukraine is not in a position to decide, once and for all, how it will develop.

The best and most effective solution can only be found through dialogue involving all stakeholders. Such negotiations must be based on principles of mutual respect and non-interference in internal affairs, and take each other’s interests and concerns into account. The Ukrainian government proposed a mechanism that would allow Russia, Ukraine and the EU to coordinate their positions. It was supported by Russia, but the EU rejected it. In the end, Brussels was too sure of the exceptional lure of its ideals, thinking that the “European choice” tag was worth any price. The political snobbism of the European Union led it to a position which proved the least constructive. However, ultimately, pragmatism will overcome emotions, and the European partners will resolve to hard negotiations.

The Russia – Ukraine – EU formula is far from optimal, and the negotiations should also involve Russia’s Eurasian partners, Belarus and Kazakhstan, whose interests should also count.

The Customs Union – Ukraine – EU format should evolve into an efficient, influential forum for discussing any pressing and controversial issues.

The Customs Union – Ukraine – EU format should evolve into an efficient, influential forum for discussing any pressing and controversial issues. It should bring together governments, supranational authorities as well as leading businessmen and major investors. No doubt it will be hard to find a mutually acceptable solution, and there will be no shortcuts. But it is possible to find a solution that all parties will find acceptable and that benefits all countries in the continent.

The main objective is a business-like, calm environment in interstate relations and during negotiations, making it easier to achieve compromises, allow for trade-offs and make reciprocal concessions.

(no votes) |

(0 votes) |