The Digital Economy in Russia. Part 2

In

Log in if you are already registered

The digital economy of Russia

[1]

[1]

In order to stimulate the Russian economy, a law was passed in 2003 to promote Russian technological advancement. The law is applicable to state-owned companies. The objective is to reduce reliance on foreign technology, build the Russian national market. This was one of the initial steps in the creation of an independent and globally leading Russian digital economy.

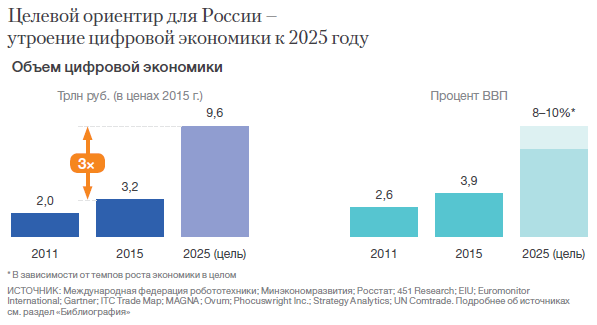

[2]Based on progress made thus far and on the government’s strategic economic plans, the digital economy in Russia is predicted to increase national GDP to 8.9 trillion rubles by 2025.[3] [4]

Presidential Decree 203 gives the strategic development of an information society in the Russian Federation between 2017 and 2030. This decree defines the digital economy as all economic activity, wherein key factors of production are digital. In comparison with traditional forms of economy, digital economy allows for more effective production, technology, supply, storage, sale, and access to goods and services[5].

The 53.14 million rubles budget will be used for the following state digital programs:

* “Information Society (2011-2020)”

* “Economic Development and Innovative Economy”

* “Development of the Transport System”

* “Development of the Electronic and Radio Electronic Industry in 2013-2025”

[6]

[6]

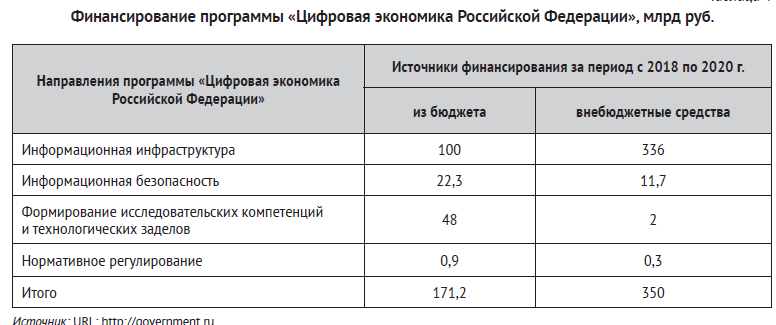

The Russian government funds five sectors of digital economy: regulation, education and human resources, cybersecurity, research, and IT infrastructure.[7] Evgeniy Kislyakov has been appointed head of the project management office.

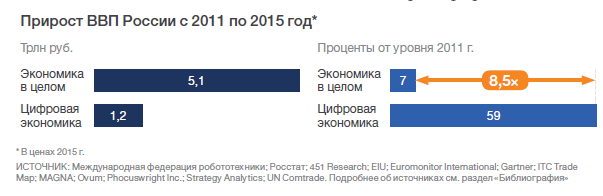

“Russia’s share of the digital economy is 2.1% — 1.3 times more than five years ago, but 3 times less than in leading countries like the United States. Russia is sixth in the world and first in Europe by number of Internet users. … Online consumption in Russia has skyrocketed in the last five years, growing by 27% per annum on average and reaching 2 trillion rubles in 2015.”[8]

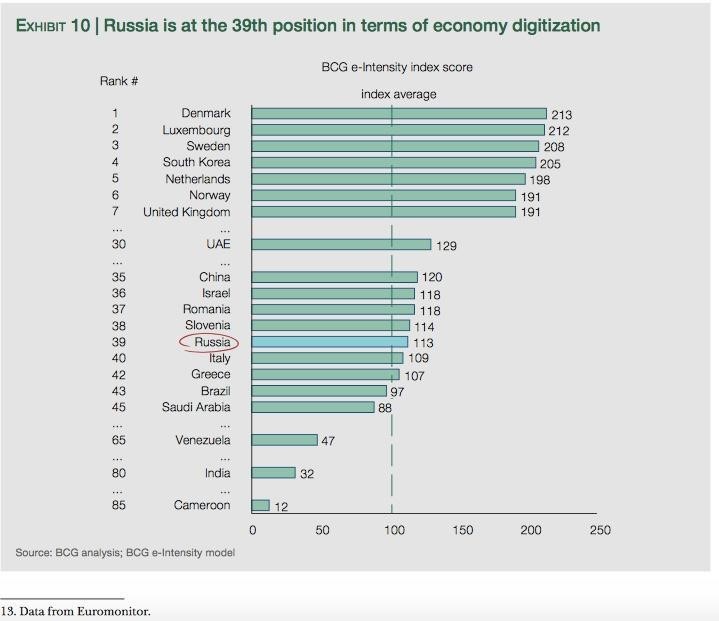

“The Russian Federation remained in 41st place in 2015 and 2016 in the Network Readiness Index, placing in the top third for Readiness, Usage, and Impact. Improvements in these rankings are anticipated as a result of the more favorable legislative climate of 2018. As mobile and fixed Internet tariffs are very affordable, 10th place overall, individual Internet usage continues to rise, leaving Russia in 40th place in this category. However, infrastructure is not keeping up with demand: Russia’s available Internet bandwidth per user is decreasing. “Although Russia is close to the median in terms of business use overall, online sales to consumers (as opposed to other firms) are particularly strong (35th place). The positive impact of ICTs is felt both in the economic and the social dimensions, as reflected in rankings in the top third for both impact pillars.”[9]

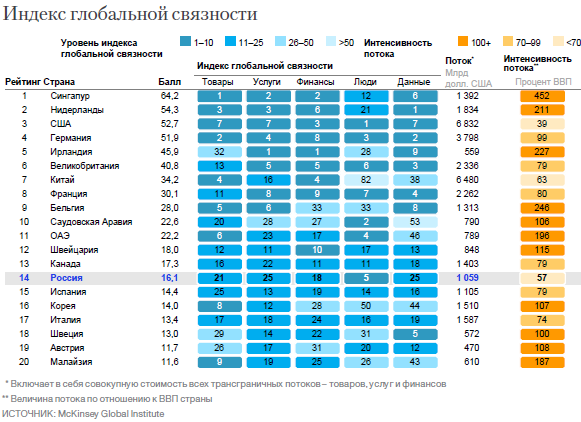

Yet each of these rankings use different statistics and indicators and evaluate slightly different aspects of digitalization, a process which is constantly changing. As a consequence of these varying approaches, the Boston Consulting Group reaches a slightly different ranking (39th) than the INSEAD, the World Economic Forum, or the McKinsey Global Institute (which ranks Russia in 14th place).[10] Rankings set the level of access to international cooperation and generally investments in the digital economy. The rankings are estimations of whom is leading the way towards the knowledge economy and forecast whom is on the fastest path to reaching the intended result. The rankings suggest are mere indicators. It is necessary to provide comprehension of the actual content of the cyber realm to the general audience so the consumers can participate in digital productivity.

The digital economy was introduced as a formal legal concept by the Russian President [11] as a new tool for the development of government, economics, business, and society.[12] The program “Digital Economy of the Russian Federation” was introduced on June 28th, 2017. The program’s plan reads as follows:

* the first section presents the fundamental ideas of the program

* the second section describes the role of the digital economy in light of relevant socioeconomic conditions, including a complex infrastructure of science and innovation, a steady increase of broadband internet use, and a market of regional services. The section concludes by asserting that locally governed digital telecommunication technologies need to be raised to a higher standard.

* the third section discusses Russia’s position in 40th place in the global digital market

* the fourth section outlines the direction of digital economic development through normative regulation, personnel and education, formation of research competencies and technical reserves, informational infrastructure, and security, as well as the main goals for each of these categories.

* the fifth section is dedicated to the governance of digital economic development with consideration to government powers, business leaders, civil society, and the scientific and education community. Governance is divided into three levels: strategic, operational, and tactical. One of the important tasks of systemic governance, the plan asserts, is the support of startups and small and medium businesses.

* the sixth and final section establishes a set of indicators and targets to be reached by 2024.

These targets are to be achieved in three phases ending in 2018, 2020, and 2024. A monitoring center will be established to oversee and perfect digital economic law.[13] The digital economy may be considered an additional layer to the traditional economy. While there is interplay between the layers, each layer requires its own regulation and rules.

The programme plans to update this new legislative framework as technology changes and predicts technological synchronization for the establishment of a digital Eurasian space.[14] The question of how to balance digital sovereignty and the safety of digital users with integration into the global digital space and transnational participation in transformative economy is approached in the plan through bilateral and regional terms.

Education is an important component of the programme plan. Incentives and tax exemptions are given to companies which educate citizens and employees in digital competencies. Citizen digital literacy competency is set to increase by 2024 from 5% to 60% and government competencies to 100%.[15]

The programme “Digital Economy of the Russian Federation”, approved by resolution № 1632-r of the Russian government on the 28th of July 2017, is intended to become the foundation for the development of this new system of governance, economics, business, social life, and society. The Russian Ministry of Communications, the Russian Ministry of Economic Development, the interested organs of the federal executive power, and the nonprofit organizations Digital Economy and the Analytical Center for the Government of the Russian Federation are the key overseers of the implementation of the programme of the digital economy. During the first stage of implementation the following agencies carry the enumerated responsibilities.[16]

More than 1,400 meetings are scheduled to take place among the indicated actors. The designated agencies and nonforprofit organization will work together in five directed programmes

“The digital economy of the Russian Federation”

“Normative regulation”

“Formation of the research competencies and technological foundations”

“Digital infrastructure”

“Digital Securitization”

to stimulate private sector actors.

The government commission for the use of information technology to improve quality of life and conditions of entrepreneurial activity was established by protocol № 2 on the 18th of December 2017.[17] Order № 1030 of the 28th of August 2017 establishes the functional structure of the new system of governance including the implementation of rules and the monitoring and control of meetings. The operation of the project office will be led by an autonomous noncommercial organization, the aforementioned Analytical Center of the Russian Government”.[18]

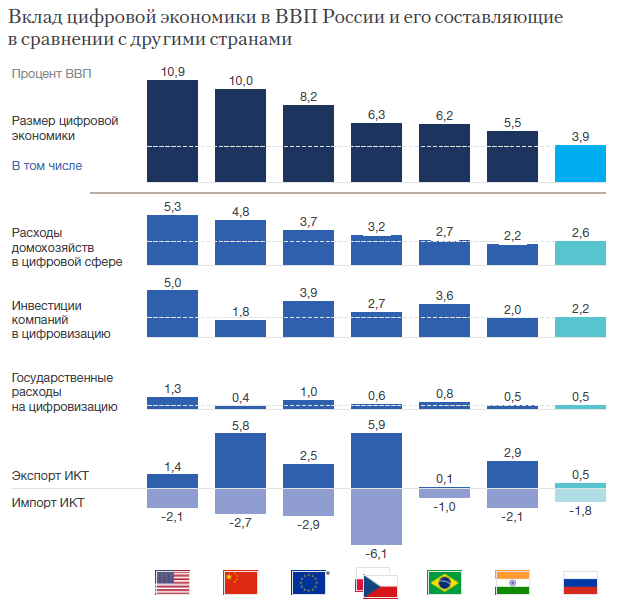

In Russia the investments of private digitalization-focused companies represent 2.2% of GDP. To compare, the United States holds the highest level globally at 5%, with Western Europe in second place at 3.9% and Brazil in third at 3.6%. “Russia is currently about 5 to 8 years behind the countries that top the rankings in overall level of digitalization. Russia’s level of infrastructure development is still higher than that of other BRICS countries, although China and Brazil are actively closing the gap, less than 1.6 times to 1.2 times in five years”.[19]

If Russia engages household, corporate, and government funds to increase its investment in Information Communications Technology (ICT) to meet the middle level of the competitors considered above, then the digital economy in Russia would grow to encompass 5.9% of GDP. Forty percent of the digital economy of Russia is currently concentrated in Moscow. Digital governance in Moscow and Saint Petersburg (for which Moscow won first place for in 2017 “Active Citizens” through e governance contribute to Russia’s position as a world leader in digitization. Eighty percent of state expenditure on information technology is concentrated in 86 regions.[20]

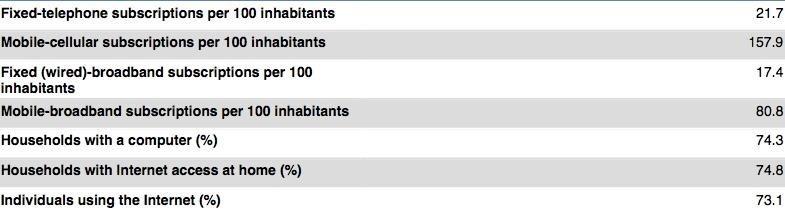

Russia measures its performance according to specific indicators. The categories of indicators used by the State Statistical Service to analyze the digitally intensive sectors of the economy as well as the categories of indicators used by the World Economic Forum Network Readiness Index in its profile of the Russian economy are included in the addendum. Standard statistics about the Russian digital sector are provided by the International Telecommunication Union.

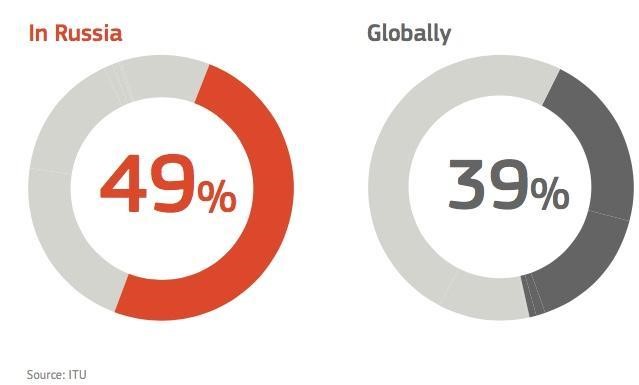

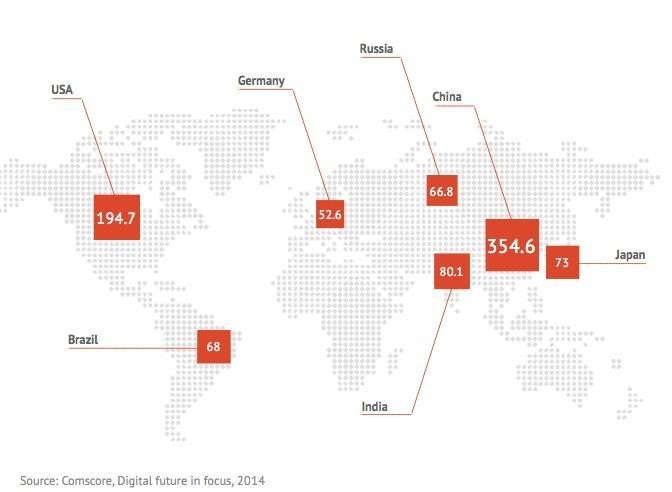

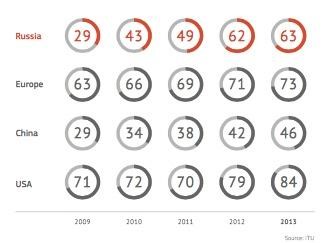

Russia ranks highly in the global telecommunications industry. By 2013, Russia was ranked first in Europe in number of TV subscribers with a 9% increase in subscribers in 2013 to reach a TV saturation level of 55%. Russia was ranked first in Europe in number of broadband internet users with over 27 million subscribers in 2013 to reach a 49% saturation level (between 60% and 80% in big cities and over 50% in cities with a population of half a million). Russia is first globally in cellular service saturation with a 166% saturation level by number of SIM cards and 110% by active subscribers. Russia is first in Europe and third globally in the number of internet video users.[21] As of February 2014, Russia’s internet user base is ranked first in Europe and sixth in the world with 66.8 million unique visitors.[22]

Cellular Service in Russia and Globally, 2009 to 2013, number of contract per 100 people[23]

Broadband access (BBA) saturation level in Russia and globally 2013[24]

In 2013 this industry was legislated as a “radio electronic” economy, referring to information transmission through radio waves. The radio electronic economy is included in the digital economy. Great progress has been made since the introduction of the 2003 legislation promoting technological advancement.

The Russian ICT sector is “one of the few sectors of the Russian economy whose growth was practically unaffected by the global financial and economic crisis. Between 2005 and 2012 the sector’s gross added value grew by 1.5 times and reached 3.8% of the business enterprise sector total whereas its share of workforce total in 2012 was 2.8%.”[28]

Now having seen Russia in the context of ICT, the specific aspects of and additional players in the Russian digital economy will be considered.

Russia’s Digital Players

The International Telecommunications Union includes the following Russian entities as official and representative members of the digital and telecommunication industry:[29]

Ministry of Digital Development, Communications and Mass Media of the Russian Federation, Moscow

General Radio Frequency Centre, Moscow

State Enterprise 'Morsviazsputnik', Moscow

Coordination Center for TLD.RU, Moscow

INTECH GLOBAL LLC, Moscow

International Organization of Space Communications INTERSPUTNIK, Moscow

Intervale, Joint Stock Company, Moscow

Joint-Stock Company National Radio Technical Bureau, Moscow

Kaspersky Lab AO, Moscow

MegaFon Open Joint Stock Company, Moscow

Moscow Technical University of Communication and Informatics (MTUCI), Moscow

OJSC 'Multiregional TransitTelecom', Moscow

PJSC «Rostelecom», Moscow

Sitronics Ex. JSC Intellect Telecom, Moscow

World's Global Telecom, Moscow

Moscow Institute of Physics and Technology (State University), Moscow

Peter the Great St. Petersburg Polytechnic University, Saint Petersburg

Saint-Petersburg State University of Aerospace Instrumentation, Saint Petersburg

The Bonch-Bruevich Saint-Petersburg State University of Telecommunications, Saint Petersburg

ITA International Telecommunication Academy, Moscow

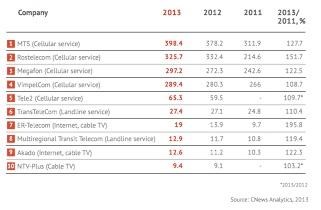

First, the main contributors and players of the Russian digital economy purely in the telecommunications industry are listed by contribution to GDP below.

Top Ten Telecommunications Companies in Russia 2011 to 2013 by Revenue in Billions of Rubles[30]

Growth Leaders in the Telecommunications Sector 2013, by Revenue in Billions of Rubles [31]

To this table must be added the space companies.

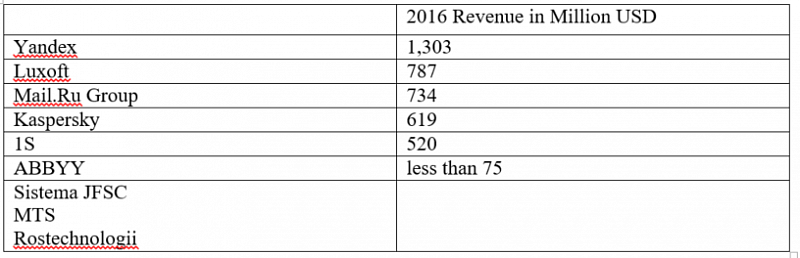

YANDEX is publicly traded and provides a range of projects similar to those of Google. Yandex added ads to its search engine in 1998 and merged its ride-sharing services with Uber in 2017. Yandex is constantly acquiring established companies and startups. MAIL.RU, founded 1998, is publicly traded and the most-visited Russian site. Naspers acquired 29% of its shares in 2007[33]. Ukraine sanctioned mail.ru in 2017.

KASPERSKY specializes in cybersecurity and is an internationally known company, handling major corporate and government contracts. Kaspersky was subject to a data scandal from 2015 to 2017.

1S was established in 1991 and is privately owned. 1S offers office software, translations of international software, video games, and Russian language programming.

ABBYY is also privately owned and was founded in 1989. Whilst it does not have high revenues, ABBYY has recognized international presence. Its products include OCR and translation.

The Russian digital IT industry, almost entirely headquartered in Moscow (save for Luxoft, headquartered in Geneva), is characterized by a focus on domestic business and lack of global presence. This paper strongly recommends turning the focus of the Russian IT industry towards international markets. Government policies were updated in 2017 to address this and must be implemented. MTS has done this successfully, becoming a recognized global brand and ranking 82nd overall and 9th among telecom providers in the 2013 BrandZ Top 100 Most Valuable Global Brands. Kaspersky and ABBYY have successfully established international presence as well, while1S localizes international software.

The second trend present in the Russian IT industry is diversification rather than specialization as a safer strategy for growth and perennity. Yandex, mail.ru, 1S are like matrioshka companies, holding many other companies within.

The third trend is a focus on data, characteristic of companies like Yandex and mail.ru.[34]

Finally, the Russian cybersecurity companies have a very strong international reputation and specific areas of unique specialization. Kaspersky is perhaps the biggest name, but there are many smaller cybersecurity companies with international significance like Group-IB where Russian programmers have an expertise or comparative advantage.

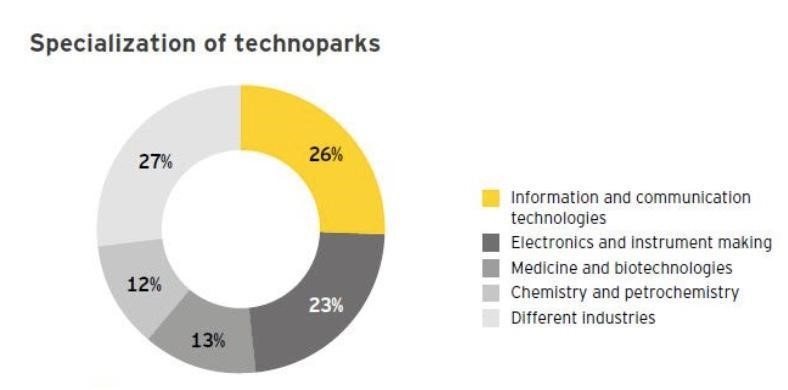

Additionally, technoparks have a historical significance in Russia, comprising one part of the foundation of the modern Russian state following the 1917 revolution. Technoparks and akademgorodoks are located throughout the Russian territory. Many of these scientific centers are secret.

Post-Soviet programs continue the tradition of technoparks and akademgorodoks with centers, such as Skolkovo, that invite foreign technology partners. While regions and universities continue to pursue digital innovations, the Agency of Technology Innovation serves as a centralized agency where each region or inventor can register and promote their innovations in a standardized and uniform matter.[35]

Yet the penetration of the digital into the Russian economy is much more profound than merely these brand names and national players. A true analysis of the Russian digital economy would require a nuanced analysis of the use of digitization in manufacturing, productivity of capital and land, and new forms of labor use through new types of employment, transformation of the labor market, and transformation of social benefits through the medical revolution related to digital technologies.

In the Russian IT industry, “there are no obstacles to introducing more progressive technologies to industry in Russia” because even though “the digital environment…requires highly trained professional programmers, developers, and equipment operators,” Russia “is globally competitive in this regard, and it boasts a substantial number of specialists in the information sciences, ranging from mathematicians and cognitive linguists to developers and programmers. The country also has a wellestablished regimen for training and retaining operators.” (RIAC 16)

Russia has taken active measures to legislate the use of new technologies to empower its economy and citizens domestically. Russia seeks to secure the practices of the digital domain through international law and organizations understand why the government and academically created R&D has not transferred into the consumer economy, a qualification must be made: Russia has the technologies of the communications and digital realm, but its relatively small internal market generates little commercial incentive. Therefore, these technologies were used for nonprofit purposes in the government sector rather than as consumer goods. “The development of the Russian digital economy was evolutionary, whereas in China it was deemed as revolutionary.”[36]The size of a country’s domestic market determines the rate of growth of that country’s digital industry. This is why internationalization of the Russian industry is of such a high priority. Just as capital was limited in the post-Soviet era and the crises periods of restricted manufacturing investments, sanctions are now posing similar halts to the industry. Removing the block structure of the economy and making networks lighter is part of the digital revolution. Yet some, especially in online sustainability, have suggested that Russia has developed new advantages and seek to regulate the use of digital and cyber tools in the international sphere. Digitation scenarios for Russia[37] in 2013 have demonstrated that Russia is on track to see a miraculous transformation similar to those of Asia.

The next section of the paper gives an introduction of indicators of more profound digitization.

Intensification of Digitization

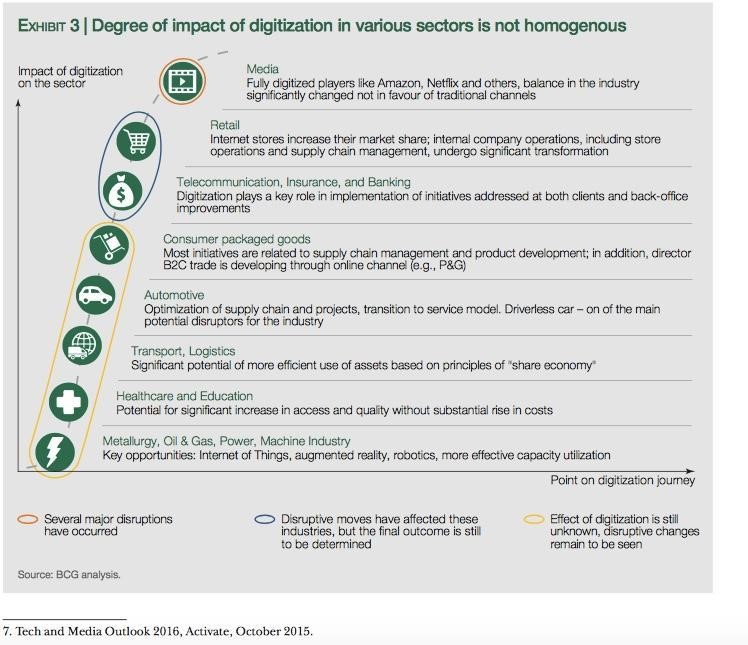

The degree of impact of digitization in various sectors is not homogenous. Because the greatest value in the economy comes from manufacturing, the digitization of manufacturing stands to generate significant revenue.

In a 2017 market study of the Russian digital economy, 94% of surveyed leading CFOs advocated a need for automation of business processes and 72% stated that they would participate in evaluation and launch of new technology solutions and innovation projects. In 2017, “the average revenues spent on innovation and digital solutions grew by half a percent to 9%, which in turn confirms the global trend of growing interest of manufacturers for technological innovation and new digital solutions.”[38]Foreign companies contribute 12% of the share of innovation spending, almost one and half times the 8% share of innovation spending of Russian companies. The top requested innovations are an introduction of advanced production technologies at 43% and a launch of technically new or advanced products at 31%.

The top technologies being implemented are energy saving technology, automation of business processes, advanced enterprise resource planning systems, e-Management, advanced equipment, R&D and growth in market research. Digitization is established through digital media. Almost half of the companies’ surveyed in Russian in 2017 plan to introduce the automation of business processes and more sophisticated technological solutions. The main constraints for the implementation are organizational structure and staffing. The economic situation in Russia and in the world continues to be a challenge.

The degree of impact of digitization in various sectors is not homogenous. Digitization of manufacturing increases revenue. The greatest value in the economy comes from manufacturing. A 2017 market study of the Russian digital economy concludes that automation of business processes was at 94%, whereas the evaluation of new technology solutions in innovation projects was 72%. In 2017 “the average revenues spent on innovation and digital solutions grew by half a percent to 9%.” [63] Foreign companies spend 12% on innovation and Russian companies 8%. There is great potential for Russian leadership of the manufacturing sector (especially compared to other economic sectors) in terms of sophistication of implemented technologies. This may be pursued as manufacturers plan to introduce more sophisticated technological solutions in the near future. At present, the technology, media and telecommunications (TMT) sector is leading the tech world in terms of sophistication of implemented technologies

In 2017, the development of innovation and digitalization in the manufacturing sector will be hindered mostly by internal constraints, while external factors will have a boosting effect. In 2017 (and roughly in the next two years), the main constraints for digital strategy implementation in manufacturing companies will be the organizational structure and staffing (as indicated by 82 and 76 percent of the respondents, respectively), while only a year ago the manufacturers spoke about the greater importance of the overall economic situation in Russia and in the world. In addition to upgrading the capital and land factors of production, digitization also impacts labor.

Improved Labor Productivity in the Digital Economy & Work-Enhancing and Self Producing Digitization [39]

In addition to platforms that facilitate online trading and markets between businesses and individuals, certain specific work platforms demonstrate the potential for enhancing national employment and encouraging domestic consumption growth strategies versus foreign trade driven growth.

Digital tools also restructure the organizational culture. Corporate structures in the services area are leading the way to increase employee productivity and satisfaction.[40]Policy and regulatory issues have brought to light sector-specific issues such as those related to transportation and accommodation, or transversal issues related to labor markets, consumer protection taxation, and competition and privacy[41]

The opportunities from new forms of work in the digital economy from the perspective of labor markets include:

* flexible access to work and income

* inclusion of marginal groups in the labor force

* easier entry and exit from work

Opportunities from the perspective of working conditions include:

* flexible hours and space for digital services

* autonomous work organization

* potential for productivity gains

Challenges from new forms of work in the digital economy from the perspective of labor markets include:

* nonstandard work, small odd jobs, and micro tasks

* unreliable and low wages, penalties for undocumented revenues

* less employer investment in training of employees

Challenges from the perspective of working conditions include:

* job insecurity and higher unemployment risk

* more costly social protection and benefits

* potential stresses of self management and social inclusion[42]

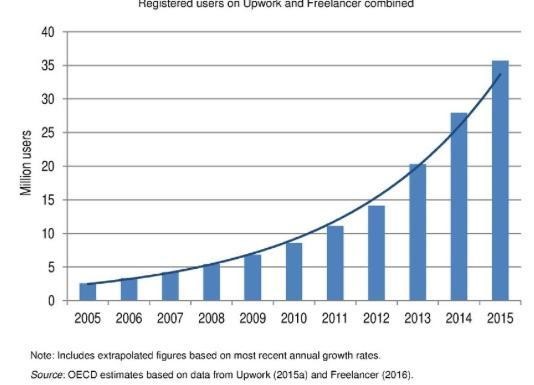

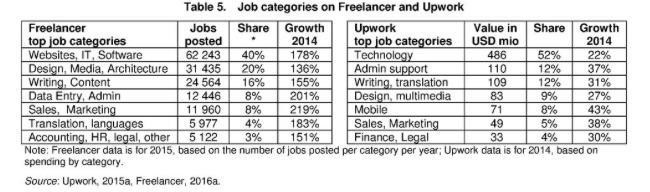

[43]“With over thirty-five million registered users combined, the two current largest non-standard work platforms are Upwork and Freelancer. By the end of 2014, Upwork had registered a total of 9.7 million freelancers and 3.8 million business and reported USD 3.2 billion in service provider earnings (940 million in 2014, all categories combined) since the platform’s inception in 2009 (Upwork, 2015a). Freelancer reached USD 3 billion of all-time posted project and contest value in 2015 (Freelancer, 2016a).”[44] The growth rate of registered freelancers is rapidly increasing, as seen in the chart below.

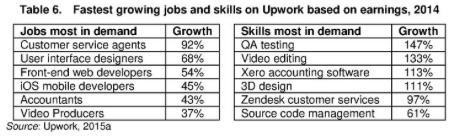

These types of employment opportunities are include technology, administrative support, writing, translation, design, architecture, and multimedia work.[45]

Russia has a highly capable labor force in information technologies and defense systems. Russia ranked 45th in the Global Innovation Index in 2017, but has one of the highest percentages of population in higher skilled labor, 77%.[46] The quality of its digital engineers, including in cybersecurity systems, is demonstrated and unique. The Russian worker is very cost efficient and competitive in budget.

Fastest growing jobs and skill in Upwork based on earnings, 2014

Digitization of Healthcare Services and the Impact on Labor Cost Reduction

A section of the Russian government’s 2017 plan includes information infrastructure replacing the current manner of timekeeping by replacing the labor books with “personal trajectories of development.”[48] The trajectory of the digital economy, its digital tools, and the anticipated revolution in biomedicine is relevant from the perspective of: 1) its contribution to the productivity and costs of labor, and 2) as a revenue-generating invention.

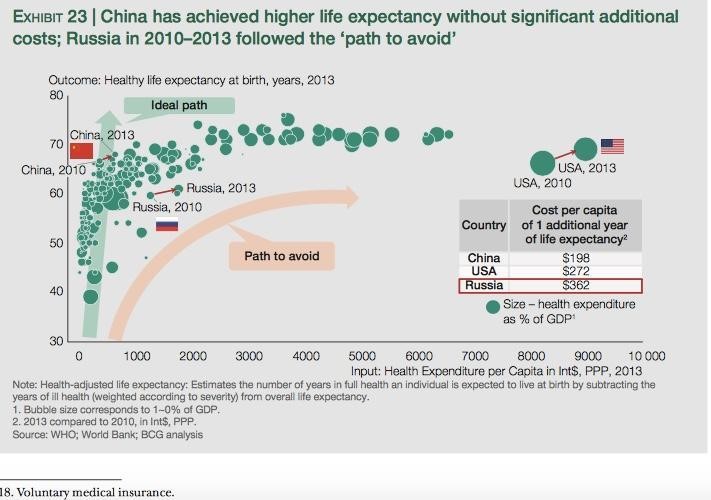

Achieving higher life expectancy in 2010 to 2013 according to a higher path

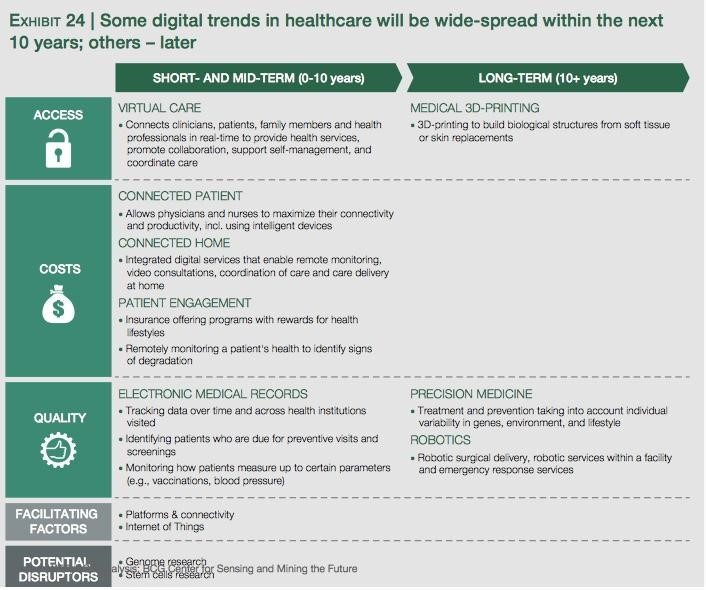

Some digital trends in healthcare will be implemented in the next ten years, while others will come later.

Digitization in energy infrastructure

"The complete digitization of Russian [electricity] networks will cost 2 trillion rubles (around $35 billion)... But we will certainly achieve it,” said Alexander Novak, the Russian Minister of Energy. Russia spends about 4.5 percent of GDP annually on improvements to infrastructure, says energy minister”[49] Returns on investment will gather quickly though in more than one year.[50]

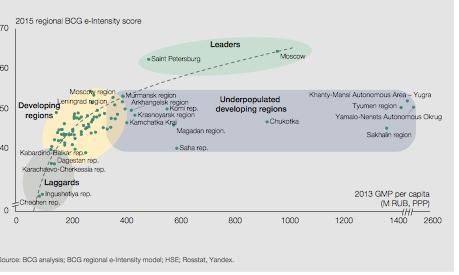

Regional Connectivity Improvement of Infrastructure

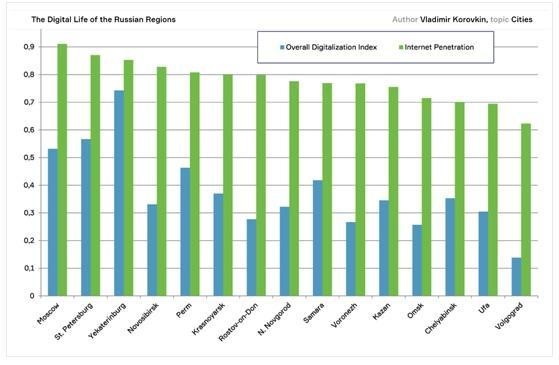

“Due to a more even infrastructure distribution, the digital gap between Moscow and the periphery has been reduced from 2.6 to 1.353. This is a major achievement of the digital economy. The degree of digitization still varies from one region to another, which gives us reason to identify four main groups.”[51] Regions become actively involved in the digital economy as soon as access to the technological infrastructure becomes available, although there is still inequality in a number of additional indicators. The gap between Moscow and the periphery with regards to the penetration rate of digitization in government services is between 3 and 5, while the gap with regards to use of digital opportunities in business activity is between 2 and 3.[52]

Russian regions[53]

The three stages of digitization are emerging, transitioning, and transforming. Russia is steadily on the transformative track. In the meantime, it is necessary to control the risk from investment in digital R&D and the time-lag from invention to standardized implementation. Five years has seen the rapid growth of new Internet-dependent segments: tourism, gaming, media, banking services, etc. Overall, these segments represent over half of the entire e-commerce industry. “Since 2010 the cross-industry effect of digitalization has increased by a factor of 5.5, from 5 to 27.7 trillion rubles. This is the result of the introduction of electronic trading platforms, the growing number of bank card transactions, ROPO2 and online advertising segments.”[54] The challenge is that with the export rate still high and investment growth grinding to a halt, the digital economy’s share of the GDP has been stagnating since 2014. “At the same time, the key drivers for digital strategy implementation in manufacturing companies are the market and competition, which reaffirms the recovery processes in the economy (both in Russia and globally) and the natural demand for innovations and digital developments.”[55] The new 2017 policy should revitalize the digital economy to overcome the constraints resulting from the sanctions and generate new revenue.

The international technology market is realized through trade (intellectual ownership, high technology, and knowledge production), movement of capital (foreign investment in R&D), and use of free-of-charge sources of information (Internet, books, newspapers). The international market trades rights of intellectual ownership, patents, trademarks, industrial design and copyright. This trade mostly takes place between affiliated corporate structures.

Innovations contributing to commercial economic growth include:

*digitization of retail payments

*mobile telephone use

*price discrimination in the digital economy

*information goods

*internet auctions

*security against digital piracy

*internet defense and privacy

*internet-empowered telephone use, credit cards, videogames, B2B commerce

Techniques for pricing include bundling information goods, software platforms, and a two-sided B2B platform.[56] Price discrimination arises from indirect appropriation. Value is also created from the legal protection of internet sectors of the economy which include:

*the music recording industry

*open-source digital products

*digital distribution channels

*online platforms that offer access to music and other digital products

*to advertising-based media

*internet retailers

IP protection legislation includes two separate IP regimes:

1) patents, trade secrets, trade markets

(such as, inventions, processes, machines, brand names, industrial designs)

2) copyright of literary, musical, choreographic, dramatic, artistic works

IP protection legislation is influenced by two major trends

1) digital technologies have enabled the competitive and high-quality reproduction of copyrighted works, especially music and movies

2) the Internet has further facilitated consumer ability to find and redistribute digital content.

Privacy and defense products are an important vital component of the digital economy. Challenges facing information security include misaligned incentives and information asymmetries. AT&T CEO Edward Amoroso testified to the US Congress in March 2009 that cyber criminals’ annual profit exceeds US $ one trillion (a value equivalent to 7% of the US GDP and greater than the entire IT industry). Similar estimates have been made by other firms in the security industry[57] However, digital defense firms may overstate the problem in order to maximize profits.

Digitization of Eurasia

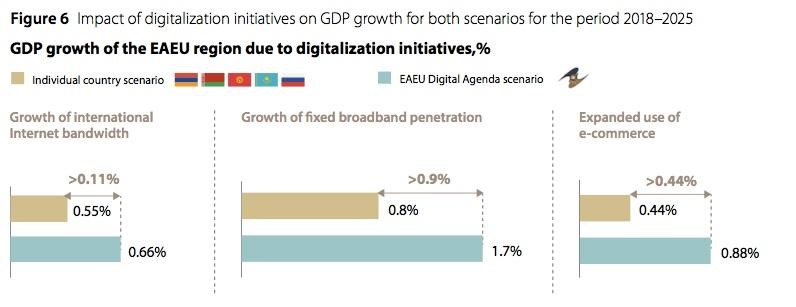

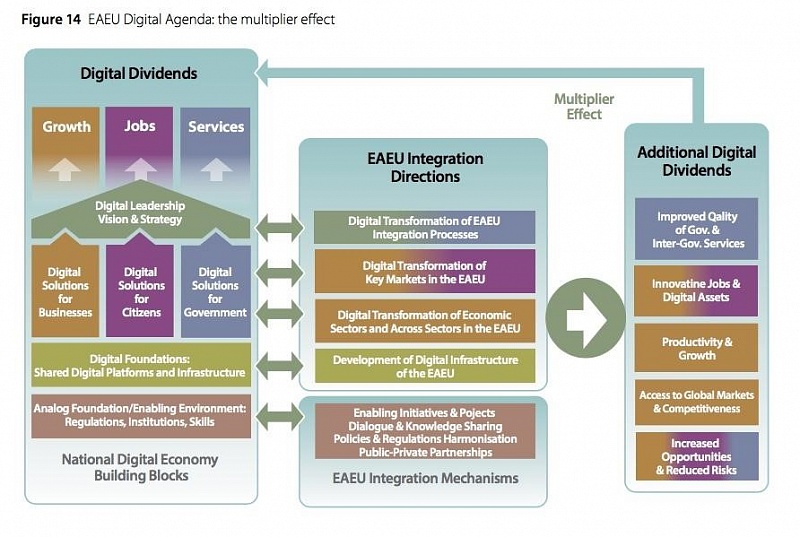

The Eurasian Economic Commission estimates that an overall gain of $46.7 billion will be made with the implementation of the EAEU Digital Agenda.[58]

In addition, gains from digitalization of governance will create additional budget resources to be invested elsewhere. For instance, the introduction of e-governance in Estonia, “a coördinated governmental effort to transform the country from a state into a digital society,” has saved 2 percent of government costs in salaries and expenses, enabling it to invest in defense spending and membership in an international defense alliance.[59] Russia has firmly implemented digital governance in order to lower government expenses, compensating for that which is lost due to sanctions.

Russia has long been a global leader in space exploration. As a result of Russia’s advancements in high technologies in 2018, the country now has the potential to become a global leader in the evolving digital sphere. For instance, the “Ministry of Communications supports plans for a fibre link between the UK and Japan via Murmansk and Vladivostok; Rostelecom was appointed the sole universal telecom services provider, contracted to develop a telecom network offering improved services to 13,600 villages; Rostelecom Polarnet is building a $2 billion trans-Arctic cable.”[60]

At the international level, Russia is taking a digital legislative leap. Dmitry Medvedev, speaking on behalf of the Russian government, and Andrey Krutskikh, special representative of the Russian President on cyber and digital issues, stated the necessity of reliable, easy, and transparent regulation of digital processes, especially at the cross-border level. An important challenge here will be resisting hacker attacks, cyber fraud, and terrorist activities.

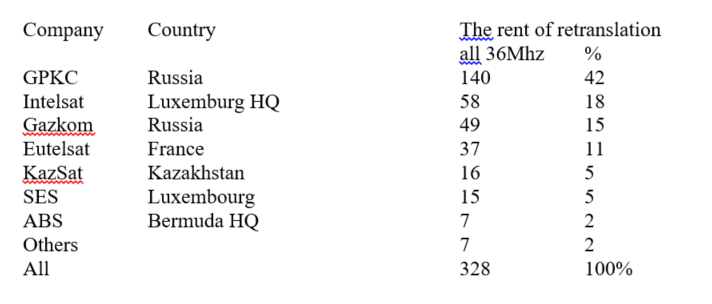

The Eurasian space is currently structured according to a pattern of inter-national interactions, including those between Russian and Chinese telecommunications TNC’s. The Eurasian Commission is open to applications from any company that plans to help build up the digital infrastructure of Eurasia. The following companies manage the Eurasian region’s satellite coverage:

Company Country The rent of retranslation

all 36Mhz %

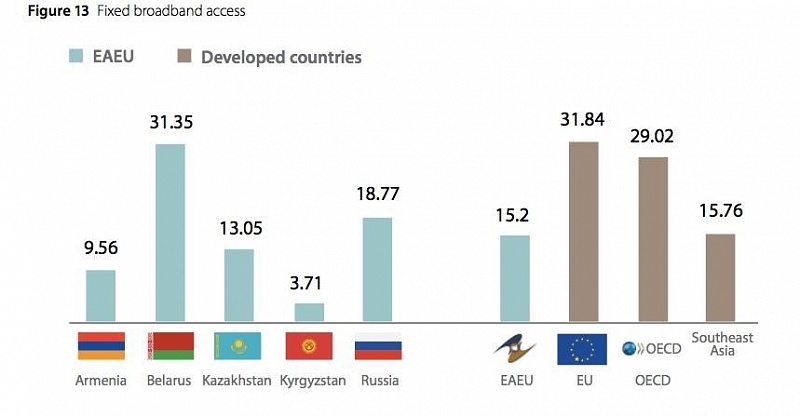

The figure above shows the level of broadband penetration. Intergovernmental agreements in the digital sphere, such as participation in Glonass with Kazakhstan and others, set the foundation for further digital interaction among smaller private companies. The economic benefits from digital integration can be observed in the desired results of international cooperation, such as the EAEU attempts to achieve greater access to and international compatibility of the tools of the Fourth Industrial Revolution. With regards to the New Silk Road, “Already, the range of institutions contributing to Eurasia's infrastructural integration extends beyond the AIIB to include the BRICS Bank, … no corridor is as significant, nor could progress as quickly, as that through Russia.”[62] The key factors in digitization readiness are enumerated in the figure above.

The digitalization of the Russian economy thus occurs on four levels: the local or city level, the national level, the regional level (the Eurasian Union, EU, and BRICS), and the global level. Russia has already achieved internationally recognized results at the city level with its e-governance structure in Moscow. The most difficult level is the global level, as it requires digital and technological harmony among many states. Advances within this realm are encouraged through bilateral agreements or multilateral agreements, such as ITU, IMF, and OECD, which must all be periodically updated to reflect the rapid rate of technological transformation. The greatest advances are currently being made at the national level. The Eurasian Union dialogue and the excitement around the potential of cooperation for greater international engagement stimulate and accelerate national digitization programs. Drafting policies on a state-by-state basis allows each country to learn from the others. Each state has a particular and unique aspect to contribute, and national programs are empowered by alternative ideas and international cooperation.

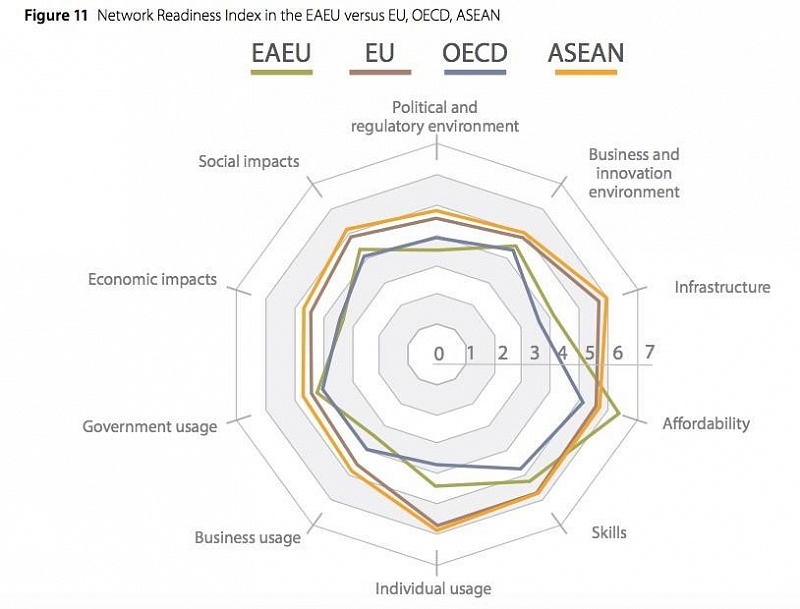

The most recent EAEU joint meeting discussed the digital agenda. With each member discussing the benefits of joining the digital sphere, Belarus and Russia each presented a different complementary three point program. Dmitry Medvedev presented the Russian Federation’s proposal which proposed a model of digital integration in three elements. The compatibility for digitization is determined by the state’s network readiness, including political and regulatory, and innovation environments, infrastructure, affordability, skills, individual, business and government usages, economic and social impacts.

The Eurasian Economic Commission estimates that overall a gain of 46.7 billion Dollars will be made with the implementation of the EAEU Digital Agenda. [85] Analogous to the pipeline infrastructure projects, the telecommunication links and potential for the Eurasia continent can create stronger links and interdependence. The common infrastructure is implemented by regionally based TNCs. The combined GDP of the Eurasian Economic Union EAEU could increase by 1% growth, create 8 million new jobs and bring USD 50 billion in savings to businesses, in addition to the gains from e governance. (2018 Saint P)

Digitalization of governance liberates budget for alternative use. Currently it simply compensates what is foregone due to the sanctions.

Russia is a regional and global digital hub. Since the turn of the 20th century, Russia has been first and continues to lead as the space center hub for human galactic, leading regionally and globally in integration of the digital sphere. The path in high technologies launched in 2017 makes Russia open to the future. Digitization occurs on four levels: the local or city level, the national level, the regional level with Eurasian Union, EU and BRICS, and the global level. The most difficult level is the global as it requires harmonization amongst states. Advances are encouraged with bilateral agreements or via multilateral formats ITU, IMF, OECD.

The Eurasian space structures itself by a pattern of interactions between Russian and Chinese TNC’s in the sphere of telecommunications and satellite coverage. The Eurasian Commission is open to have applications from any company to modernize the Eurasian infrastructure by multilateral consensus. Intergovernmental agreements in the digital sphere, such as participation in Glonass, set the environment for interaction of smaller companies.

The Eurasian dialogue for greater international engagement stimulates the national digitization programs and enables learning from each others’ successes and drafting policies by state groups. Each state has a particular and unique contribution. National programs are enriched by the alternative ideas and cooperation.

Dmitry Medvedev presented the Russian Federation’s proposal, digital integration according to three elements. EAEU Data X is a single platform for electronic data transfer of information, and relevant legal protocols between private companies. EAEU ID is a single electronic confidence space with services for identification, authentication, authorization, digital archiving. EAEU Geo a geographic information system and cartographic base services, to facilitate monitoring transportation and traceability of products.”90

Harmonizing standards includes establishing national antivirus programs with Russian cryptographic algorithms on all personal computers produced or introduced in the EAEU by 2021. [92] Belarus proposed transition from a coordinated policy in the digital sphere to a single strategy for participating countries of the Union, common management of common infrastructure and digital transport corridors in the East-West direction. [91]Kyrgyzstan aims to increase the state budget revenues, eradicate certain corrupt elements, such as blockchain adds levels of instantaneous verification preventing corruption.Sapar Isakov 93 It is a synergetic process initiated by the EAEU members.

Belarus proposed two initiatives for the EAEU common space. “ The first one is integration of the digital infrastructure of the EAEU countries, which involves …introduction of uniform standards, common management of the physical infrastructure, and formation of full-scale digital transport corridors running East-West.” The second initiative outlines a transition from a coordinated digital policy to a single strategy for the digital transformation of participating countries. It establishes general principles and approaches along with methods for the implementation of specified goals.[63]

Russia has legislated its intention to harmonize standards across Eurasia. “National antivirus programs will be required on all personal computers produced or introduced in the EAEU. By 2021, the majority of participants in the international agreement will be required to use Russian cryptographic algorithms.”[64]

Kyrgyzstan promoted and highlighted its digital program Taza Koom, whose aim, according to the country’s leader Sapar Isakov, is to “optimize government expenditure, increase the state budget revenues, and eradicate certain corrupt elements.”[65] This particular initiative supposes that with a clean slate in a new realm, it is possible to create patterns of economic interaction that remove some of the imperfections, information asymmetries, and criminal aspects of the digital economy. Blockchain and cryptocurrencies add levels of instantaneous verification to prevent corruption. Simultaneously, the valuation of the currency can be linked to intellectual creation by solving mathematics problems. Thus using the human mind as resource rather than depleting natural resources. An inherent element of productivity and innovativeness in the very creation of the currency. Digital currencies will be more useful when usable across borders and convertible to traditional monetary means. With a clean slate in a new realm it is possible to create patterns of economic interaction that remove some of the imperfections, information asymmetries, and the informal and criminal aspects of the digital economy.

From the foundation of the Eurasian digital space, cooperation in digitization with other regions or countries has been possible. Current economic conflicts can be overcome with digital means. Bitcoin and Blockchain are major subjects of Russian discussions about the direction of its economy and have been a regular feature of the Keiser Report on the television channel RT (Russia Today) for many years.

Conclusion: The global digital economy and Russia’s role in digital globalization

Creating Russian innovations and stimulating Russian designs into national and international consumer goods is a challenge. The West has countered the global integration of Russia. The Western states’ motivation is political and economic, because Russian entrepreneurs are rising competitors to the established multinationals. The political destabilization and economic sanctions limit the globalization of Russia’s market. The entry barrier for Russian entrepreneurs is high. The sanctions can be overcome through digital solutions that enable reliable interaction.

“… both Russian and EU businesses will be able to find new methods of doing business with each other, … provided an opportunity to create new cross border value links with Russia as the de facto vast border region between China and the EU.” [94]

The digital economy program can compensate from the sanctions by generating entrepreneurial renaissance and by establishing trust from its international economic partnerships.

The strategy is to transition the government and academically created innovations into the consumer economy. The size of the domestic market determines the rate of growth of the digital industry. “The development of the Russian digital economy was evolutionary, whereas in China it was deemed as revolutionary.”61 Internationalization of the Russian industry is a high priority to increase the consumer market size and create demand for Russian innovations. Investments in innovations of the already established industrial centers were limited in the post Soviet transition.

Now sanctions are posing halts to the economy. Whilst Russia has proven knowhow in building information systems, overcoming political stigmatization abroad is a challenge. Political trust building is one aspect, yet the power of the digital tools and programs would in and of itself be a success. Completing the process of building economically viable and advanced information systems nationally is a prerequisite to establishing a global presence. The level of digital governance of Moscow and Saint Petersburg contribute to setting the level of high achievement at world leadership in digitization.

The Russian digital economy would also alleviate economic pressures from the sanctions as it is forecast to increase the GDP to 8.9 trillion Rubles by 2025.[28] [29] Digital consumption in Russia already surpassed the level of 2 trillion Rubles in 2015.[34] If Russia increases the volume of its investment in ICT, including through household budgets, investment companies and the government, up to the middle level of the considered competitors above, then the share of the digital economy in Russia would grow to 5.9% of the GDP. [46]

These goods, services, and tools are useful in reshaping the “structure of global Internet infrastructure because many countries insist on building their infrastructure according to principles that differ from those that governed the first and second waves of investment in the United States.”[66] Access to new technologies as well as integration into the global knowledge society were key driving forces of the transition begun in the 1980s.

In order to participate wholeheartedly in the fourth industrial revolution, several strategies are recommended: inviting professors, leading product engineers, and designers; purchasing smaller, innovative venture firms that manufacture digital goods; and supporting advertisement and market creation for digital products. In order to stimulate innovation, it is necessary to protect intellectual property rights over digital goods and services. The greatest challenges are protecting the digital environment from cybercrime, overcoming the digital divide, and protecting intellectual property rights as a means of value creation. To implement the necessary programs, harmonization and cooperation between ministries must be achieved. Then, regional integration through a single EAEU digital platform must be launched with optimal conditions for technological business activity.

While the focus had primarily been on the economic value of the digital economy, “A distinctive feature of our time is that practically all branches of science and technology, including the life sciences, are integrated into the digital environment.”[67] Subsequently, the costs of society may be greatly reduced by the reduction of health insurance or energy costs. The transition to a digitized society will transform the costs faced by society, the taxation structure, as well as the nature of the marketplace, including labor, enabling individual-to-individual transactions. “The boundaries between public and private infrastructure should change as a result, as should the characteristics of the governance and pricing of Internet infrastructure.”[68] Russia has been a world leader in governing the social impact of the digital economy as both a tool of empowerment and a source of danger. The scope of the digital transformation of the Russian economy has been exemplary and is receiving renewed state guidance. The digital economy should be additionally sponsored as an opportunity for increased state revenue for the Russian government. The horizon of the digital frontier is infinite, and many of the innovations to come are beyond the frame of current imagination.

Digitalization is, at its most basic level, information inscribed in atoms. As with electrons in an electrical current, the information is transmitted in networks of continuous flows through a virtual and physical infrastructure. The merging of content and matter into the virtual, such as cryptocurrencies or electronic currency backed by the value of electricity, connects the monetary to its means of apparition in the world. Innovation is the driving force of the development of the digital economy.

Bibliography

Articles consulted from Introducing Russia Digital http://digital-russia.com

Агеев, Александр. “Цифровое Общество” и “Сизифов труд” Экономические Стратегии Академический Бизнес Журнал 2(152) 2018, индексы 79369, 79992

Baller, Silja et al. (editors) “The Global Information Technology Report 2016: Innovating in the Digital Economy” Geneva, Switzerland: World Economic Forum and INSEAD, 2016. http://www3.weforum.org/docs/GITR2016/GITR_2016_full%20report_final.pdf

Russia country profile in Network Readiness Report http://www3.weforum.org/docs/GITR2016/WEF_GITR_Russian_Federation_2016.pdf

Винокуров, Евгений и Александр Либман. «Евразийская Континентальная Интеграция». Евразийский Банк Развития Центр интеграционных исследований, Санкт-Петербург, 2014.

Булатов, Александр Сергеевич. «Мировая экономика и международные экономические отношения. Полный курс» Москва: МГИМО, 2017.

Brynjolfsson, E. and McAfee, A. “The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies.” New York: W. W. Norton & Company, 2014.

Столова М.И. и Е.А. Бренделева. “Основы Цифровой Экономики” Москва: Издательский дом “Научная Библиотека”, 2018.

International Monetary Fund. “Measuring Digital Trade: Results of the OECD Stocktaking Survey”. Paris, France: IMF and OECD, October 24 to 26, 2017. https://www.imf.org/external/pubs/ft/bop/2017/pdf/17-07.pdf (accessed on 01.04.2018)

Khanna, Parag. “Russia on the Digital Silk Road” http://article.digital-russia.com/silk-road/

Капранова, Людмила Дмитриевна. “Цифровая Экономика в России: Состояние и перспективы Развития” “The Digital Economy in Russia: Its State and Prospects of Development” Экономика и Управление №2 2018, 58 - 69

Kotov, Ivan (editors et al.) “Russia Online: Catch Up” The Boston Consulting Group, June 2016 http://image-src.bcg.com/Images/Russia-Online-ENG_tcm26-152058.pdf

Крутских, Андрей Владимирович. “Технологический прогресс современные международные отношения” Москва: “Просвещение” 2004.

Крутских, Андрей Владимирович. “НТР и Мировая Политика” Москва Издательство МГИМО Университет, 2010.

RIAC “Working Paper: Russia and the Challenges of the Digital Environment” 2014.

Russian Investment Fund. “Telecommunications Industry” http://investinrussia.com/data/files/sectors/RCIF-Brochure-TeleCom-Eng.pdf

Peitz, Martin and Joel Waldfogel (editors). “The Oxford Handbook of the Digital Economy”. Oxford University Press, 2012.

Shwab, Klaus. “The Fourth Industrial Revolution” 2016

Sokolov, Alexander https://www.hse.ru/data/2015/03/20/1092927841/Technovation_CHULOK.pdf

Шаклеина Татяна и Андрей Байков Глава 14 “Глобальная инновационная система: тенденции свойств эффекты” в Мегатренд Москва : Аспект Пресс, 2013.

Aptekman, Alexander. “Цифровая Россия: новая реальность” or “Digital Russia: a new reality” July 2017. https://www.mckinsey.com/~/media/McKinsey/Locations/Europe%20and%20Middle%20East/Russia/Our%20Insights/Digital%20Russia/Digital-Russia-report.ashx (accessed on 18.05.2018)

Доклад «Цифровая экономика: глобальные тренды и практика российского бизнеса».

Report “Digital Economy: Global Trends and Practice of Russian Business” https://imi.hsi.ru/pr2017 (accessed 08.05.2018)

http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/science_and_innovations/it_technology/#

www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/science_and_innovations/it_technology/#

International Telecommunication Union

https://www.itu.int/en/ITU-D/Statistics/Pages/stat/default.aspx

ОЕСD databases and information, additional reports listed in the footnotes

http://image-src.bcg.com/Images/Russia-Online-ENG_tcm26-152058.pdf

http://www.gks.ru/

http://www.gks.ru/wps/wcm/connect/rosstat_main/rosstat/ru/statistics/science_and_innovations/it_technology/#

The Ministry of Telecom and Mass Communications of the Russian Federation

www.minsvyaz.ru

http://tass.com/economy/997051

https://data-economy.ru/science

http://static.government.ru/media/files/9gFM4FHj4PsB79I5v7yLVuPgu4bvR7M0.pdf

http://static.government.ru/media/files/1P5evO23war1woLA0q8aJ2DtAqsydInS.pdf

http://static.government.ru/media/files/zutOPH6TyKz2ciJAFcn74orvpb89UCMa.pdf

Rosstat http://www.gks.ru/free_doc/new_site/business/trans-sv/gr_sv.htm

https://asi.ru/ http://1c.ru/ http://rostec.ru/ http://rosatom.ru/

http://files.data-economy.ru/digital_platforms.pdf

Ranking statistics cross checked with national data

http://minsvyaz.ru/en/activity/statistic/rating/indeks-ekonomiki-znanij/#tabs|Compare:Points

[1] Aptekman et al, 2018, 31

[2] Aptekman et al, 2018, 35

[3] Aptekman et al, 2018, 8

[4] Aptekman et al, 2018, 32

[6] Kapranova 2018 66

[9] Baller, Silja et al. (editors) “The Global Information Technology Report: Innovating in the Digital Economy” Geneva, Switzerland: World Economic Forum and INSEAD, 2016. p.28 www.weforum.org/gitr and https://www.wsj.com/public/resources/documents/GITR2016.pdf (Accessed on 16.5.2018)

28 http://reports.weforum.org/global-information-technology-report-2016/

[11] Stolbova, 2018, 199

[12] Putin, Vladimir. “Formulating the digital economy : a question of national security of the Russian Federation” http://tass.ru/ekonomika/4389411

[13] http://static.government.ru/media/files/9gFM4FHj4PsB79I5v7yLVuPgu4bvR7M0.pdf Stolbova, 2018, 199-200

[14] Stolbova, 2018, 201

[15] Stolbova, 2018, 203

[18] https://data-economy.ru/science «Аналитический центр при Правительстве Российской Федерации»

[19] Aptekman, 2018, 34

[20] Stolbova, 2018, 63

[22] Invest in Russia, p.6

MSc in Political Science, Columbia University

Blog: Anna Maria Rada Leenders' Blog

Rating: 1